The Weekly: Takeaways from 2025’s Climate Disasters

Twenty-three billion-dollar disasters, $115 billion in damage, and not one hurricane: 2025 was a masterclass in how climate risk in the U.S. has changed.

Each time the federal government closes, it reinforces a simple truth: the center can no longer hold. The work of building resilient infrastructure and communities must now happen locally.

By Matt Posner, Contributing Author for The Epicenter and Head of Public Finance for The Resiliency Company

The second-longest government shutdown in American history has far-reaching impacts for public finance, resilient infrastructure projects, and disaster response. The problem is that many of the second- and third-order implications are less invisible, or their impacts long term and structural in nature.

As the clock continues to tick, the costs continue to compound. Here are seven implications of the ongoing shutdown—spanning public finance, resilient infrastructure, and disaster response—that, together, make a larger point: in an era of recurring federal uncertainty, the path forward for resilient infrastructure lies in re-centering action at the local level.

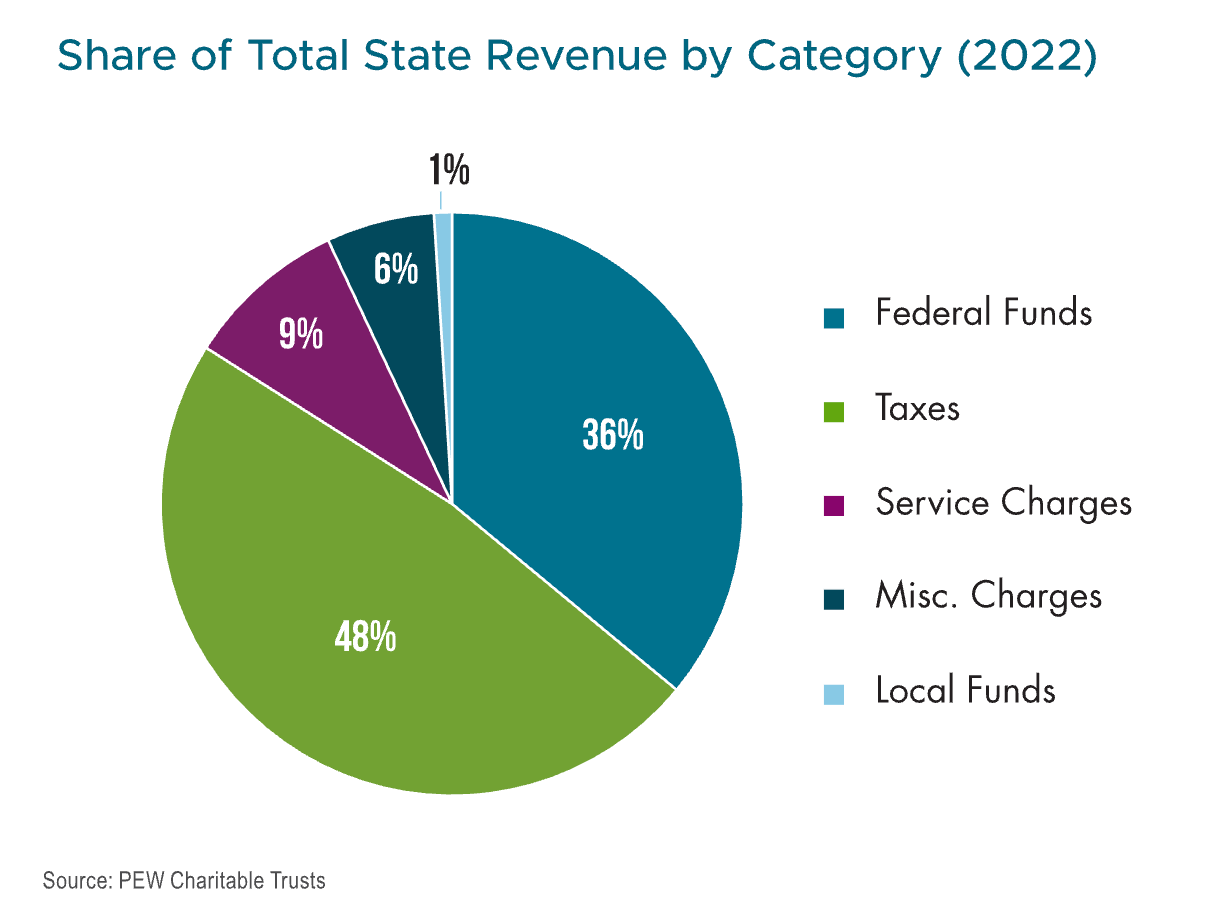

In the short term, a federal shutdown doesn’t immediately change municipal credit fundamentals, but it does introduce a layer of uncertainty that markets price in over a longer horizon. All else being equal, state budgets are more reliant on federal dollars than local ones. The healthcare and public higher education spaces are also where federal resources are more relevant. This becomes especially true for largely rural states. These comments are intended to be high-level entry points that require much more nuance to engage in. They are a starting place for any thinking about muni credit exposure during a federal government shutdown.

For specific projects that rely on federal funding in the water and transportation sectors (like San Diego’s Water Revenue Bonds for its Pure Water program), the reliance on the federal government leaves these bonds exposed. Investors will get jittery, and perhaps some spread widening will become evident as investors exit those projects. Meanwhile, new issuance of federally dependent bonds may slow until the shutdown is resolved. The longer the government stays closed, the harder it becomes to maintain confidence in project pipelines.

Many infrastructure programs rely on active federal administration even when their underlying funds are intact. A prolonged closure means fewer staff to review applications, approve allocations, and issue guidance. Transportation, water, and energy projects that depend on federal sign-offs—like the Transportation Infrastructure Finance and Innovation Act (TIFIA) or the Water Infrastructure Finance and Innovation Act (WIFIA) loans or some Private Activity Bonds—can get stuck in administrative limbo. For issuers, that translates into higher carry costs and deferred construction timelines.

FEMA’s programs—its mitigation grants, the National Flood Insurance Program (NFIP), and the Disaster Relief Fund (DRF)—form the core of federal resilience finance. When those programs falter, the entire system of community risk management begins to show strain. The ongoing shutdown has exposed that fragility in real time. A lapse in NFIP authorization has halted the issuance of new flood insurance policies, delaying home sales and dampening local property-tax revenues in flood-prone areas. Meanwhile, the FEMA Disaster Relief Fund has reached a critical low, forcing the agency to ration spending to “immediate needs” only and delay reimbursements and new project approvals.

For communities recovering from recent disasters, that means aid is delayed, and for those trying to prepare, it means no access to the funding needed to strengthen infrastructure before the next event. Local governments may utilize the FEMA cost-share agreements or mitigation grants to anchor debt issuance now face liquidity stress, higher borrowing costs, and greater credit risk. Contractors build that uncertainty into bids, and investors price it into spreads, turning federal dysfunction into a tangible cost-of-capital issue for resilience finance.

This moment may be an early glimpse of what the future of disaster response could look like if federal systems continue to erode: slower aid, weaker insurance coverage, and higher local financing burdens. FEMA’s funding stress is not just a sign of administrative breakdown; it is a warning that the nation’s ability to finance resilience depends on restoring fiscal stability and a reliable federal partner in the face of compounding climate risk.

The Inflation Reduction Act built enormous momentum for climate and energy investment, but much of that momentum is tied to clear and timely IRS guidance. When a shutdown stalls private-letter rulings or delays clarifications on credit transferability and bonus eligibility, it doesn’t just slow clean-energy projects; it undermines the broader resilience economy taking shape around them. Many of the same credits used for decarbonization (efficient housing, distributed solar, and carbon capture, for example) also fund hardening of homes, schools, and municipal buildings, or support microgrids and distributed systems that keep communities functioning during disasters. When those transactions stall, so do many of the place-based adaptation projects that depend on them. As Crux Climate recently reported, developers are already holding off on transactions while waiting for the IRS to reopen its portal to award registration numbers required for transferable tax credits under the IRA. That uncertainty translates directly into higher soft costs, delayed construction, and lost time in the communities that can least afford it.

The Greenhouse Gas Reduction Fund and related EPA programs are intended not just to lower emissions, but to expand access to cleaner, more reliable, and more affordable infrastructure, which is a core pillar of community resilience. A shutdown halts coordination, reporting, and approvals, leaving community lenders and local partners in limbo. Earlier this year, the EPA temporarily froze access to roughly $20 billion in GGRF awards, leaving green banks and community lenders unable to move projects forward. As Columbia Law School’s Climate Change Blog reported, the pause disrupted distributed-solar pipelines, efficiency retrofits, and clean-energy installations in low-income neighborhoods—projects that double as resilience upgrades. When shutdowns compound that uncertainty, the effect cascades through local systems that depend on predictable capital flow. The real cost isn’t just financial; it’s the erosion of trust and the loss of momentum in the very programs meant to help vulnerable communities adapt from the ground up.

We’ve already seen this administration’s willingness to inject political priorities into infrastructure and energy programs, most visibly in its recent decision to freeze roughly $18 billion in federal funding for New York City’s Hudson Tunnel Project and the Second Avenue Subway. That move, announced before the shutdown, stopped two of the nation’s most consequential transit and resilience projects under the pretext of reviewing “DEI-related” spending. These projects were designed to modernize rail connections, reduce congestion, and strengthen climate resilience in one of the country’s most economically vital regions.

The shutdown makes this pattern worse. With agencies closed and oversight suspended, there are fewer procedural checks and less transparency around how funding decisions are made. A closed government gives political leadership wider latitude to reinterpret or withhold funding under the guise of administrative review, turning what should be neutral infrastructure policy into an instrument of partisanship.

For communities depending on a predictable federal partnership, this moment is a warning. When Washington shuts down, it doesn’t merely delay paperwork—it creates the conditions for political discretion to shape which cities advance critical projects and which are left behind. In the context of resilience, that uncertainty undercuts adaptation efforts nationwide and reinforces the need for locally controlled, durable financing mechanisms that can withstand federal volatility.

In a landscape where the federal government’s reliability has become increasingly uncertain, the cost of capital for resilience-oriented infrastructure rises almost by default. Traditionally, federal support acts as a key back-stop: grants, cost-share arrangements, federal loans, and tax-credit monetization all help reduce risk, lower borrowing costs, and accelerate project delivery. But when that back-stop falters—due to shutdowns, delayed approvals, or politicized funding—two distinct cost pressures emerge:

Together, these pressures translate into slowed adaptation and resilience outcomes and not just a schedule delay, but fewer projects delivered, higher lifecycle costs, and reduced return on public dollars. For example, research from GW&K Investment Management shows that sectors tied to federal reimbursements—such as GARVEE highway bonds backed by Federal Highway Administration payments—are most vulnerable to federal funding disruption.

Given this dynamic, one conclusion is clear: we cannot assume federal reliability. To build effective resilient infrastructure finance, we need more locally controlled capacity, diversified capital stacks, and explicit risk mitigation for federal participation gaps.

Each time the federal government closes, it reinforces a simple truth: the center can no longer hold. The work of building resilient infrastructure and communities must now happen locally. States and municipalities already have the tools, bond banks, revolving funds, special districts, and resilience authorities to move forward even when Washington stalls. Federalism gives us the flexibility to innovate, but it also shifts more responsibility onto local shoulders. The more we can generate local cash flows, design durable financing structures, and link those directly to community outcomes, the less exposed we are to political volatility at the national level.

In the near term, this shift demands discipline. Let’s recall that the majority of the bonds issued that underpin the size of the municipal market are dependent mostly on local revenues and state constitutionally mandated borrowing behavior. These projects can advance without federal approval, they prioritize liquidity to manage timing gaps, and maintain open communication with investors and rating agencies to keep confidence intact. That said, redundancy is critical; every federal grant or tax credit should be paired with a local or private bridge option so that momentum is never lost.

The long-term takeaway is that federal uncertainty has become a permanent feature of the system, not a temporary bug. The path forward for resilient infrastructure lies in re-centering action at the local level—where financing, accountability, and public benefit align. Future resilience will depend on how creatively states and municipalities use the powers of federalism to protect their people, mobilize capital, and maintain stability when Washington cannot. In this new era, resilience isn’t just about withstanding storms; it’s about governing through them.

Have thoughts to share on this piece, or want to add your voice to the conversation? Reach out!