The Weekly: Takeaways from 2025’s Climate Disasters

Twenty-three billion-dollar disasters, $115 billion in damage, and not one hurricane: 2025 was a masterclass in how climate risk in the U.S. has changed.

3% of U.S. GDP is spent every year on preparing for and repairing from disasters.

Bloomberg's investigation into America's "disaster industrial complex" finds that disaster spending now consumes nearly $1 trillion annually; that’s 3% of U.S. GDP, devoted to an endless cycle of preparing for and recovering from disasters. In the 1990s, the annual average was closer to $80 billion in current dollars.

“What that adds up to,” says Bloomberg reporter Eric Roston, “is a national economy that is spending more and more of its resources always recovering from disasters.”

Bloomberg’s "Prepare and Repair Index,” a list of 100 companies spanning waste haulers to engineering contractors to insurance companies, has outperformed the S&P 500 by 6.5% annually over the past decade.

Climate change guarantees that this will be a growth industry. The problem is that so much of this money can be spent more effectively: we continue rebuilding to outdated standards and maintaining insurance models that don't incentivize resilience. More resilient approaches to building, insuring, and investing exist. The challenge is implementing them.

As we've explored in our work on the Resiliency Delta, rebuilding to disaster-resilient standards costs more upfront—a 2025 Headwater Economics study found it adds $30,000 to rebuild a typical California home to wildfire-resistant standards. Yet insurance payouts typically fall short even of baseline reconstruction costs, let alone resilient upgrades. Homeowners must bridge that gap out of pocket.

The truth is we're already paying the resilience premium, just inefficiently. The disaster economy’s annual trillion becomes what Bloomberg describes as "a stealth tariff on consumer spending.” We're choosing to pay for cleanup and replacement—and ever-higher insurance premiums—on an endless loop, rather than paying once to build systems that withstand the storms.

The post-disaster window offers our best opportunity to break this cycle. When communities rebuild, homeowners are motivated, collective bargaining can drive down costs, and rebuilding can be more cost-effective than a retrofit. But working in this narrow window requires dedicated financing mechanisms that make resilient reconstruction accessible.

It's straightforward to invoice cleanup costs, but calculating the ROI of prevention is messier, especially when future disasters resist prediction. Still, a growing body of research confirms what common sense suggests: paying upfront beats paying repeatedly. The National Institute of Building Sciences found federal mitigation investments return $6 for every dollar spent; a study from Allstate and the U.S. Chamber of Commerce pegs it at $13-to-$1.

The disaster industrial complex isn't disappearing—but we can keep it in check. Here are three ways:

Those billions can keep chasing disasters, or we can redirect them to leverage points that save money in the long run. We're already committed to spending the money. What we get for it is still a choice.

Read the full Bloomberg report here.

Read more about insurance on The Epicenter here.

Read more about resilient public infrastructure and government solutions on The Epicenter here.

Read more about resilient real estate on The Epicenter here.

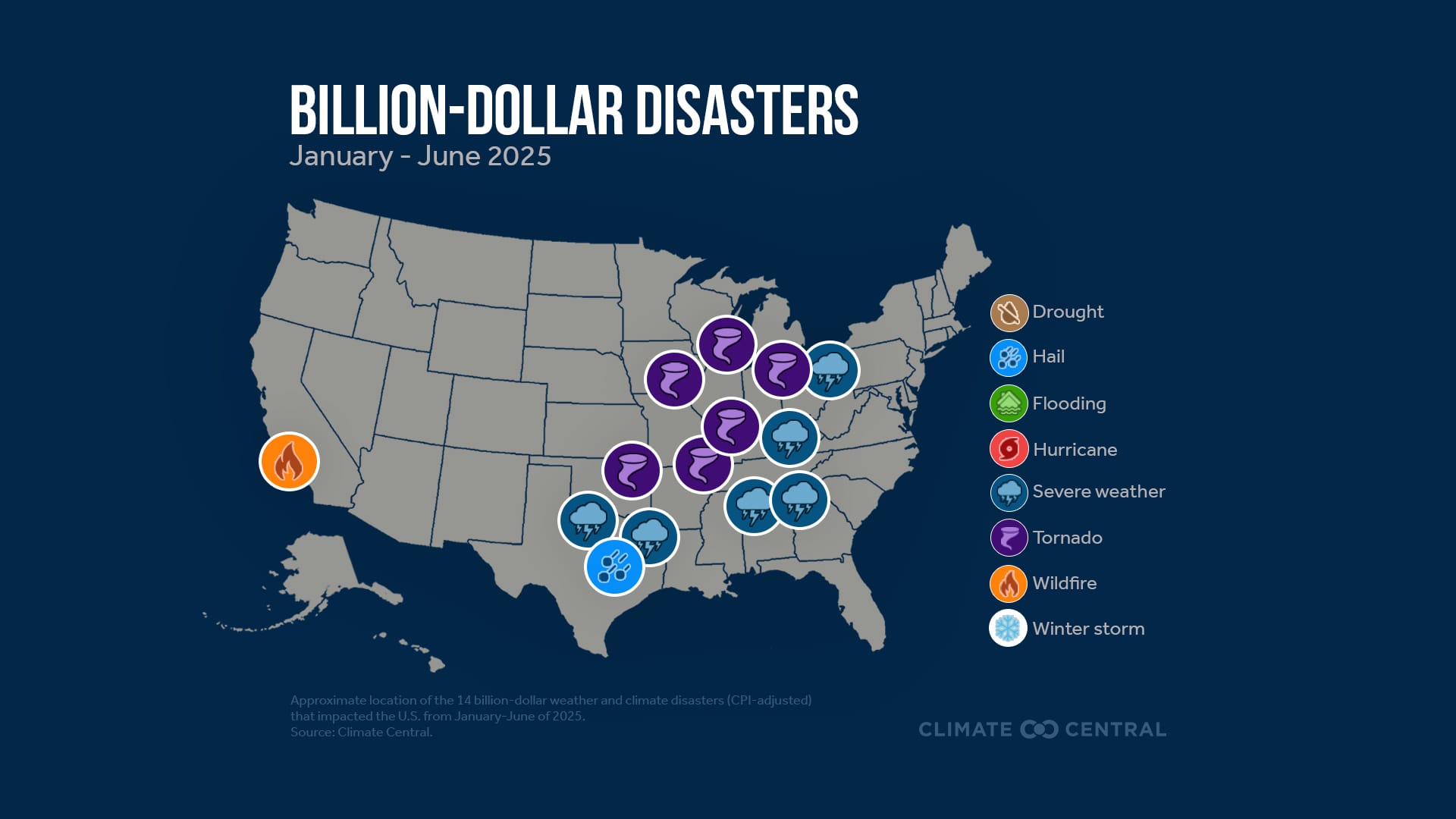

During the first six months of 2025, 14 billion-dollar disasters hit the U.S., costing $101.4 billion.

Source: Climate Central

We had to share this stunning video of footage from inside the eye of Hurricane Melissa.

Have thoughts to share or want to add your voice to the conversation? Reach out!

The Epicenter helps decision makers understand climate risks and discover viable resilience solutions. The Epicenter is an affiliated publication of The Resiliency Company, a 501(c)3 nonprofit dedicated to inspiring and empowering humanity to adapt to the accelerating challenges of the next 100+ years.