The Weekly: Takeaways from 2025’s Climate Disasters

Twenty-three billion-dollar disasters, $115 billion in damage, and not one hurricane: 2025 was a masterclass in how climate risk in the U.S. has changed.

Nowhere is the proverb “Necessity is the mother of invention" more true than in today’s insurance industry.

The frequency and severity of disasters are forcing insurers to rethink everything: from premiums to the products themselves. Insurers are racing to update their models, reduce exposure, and develop products for hazards that were once too diffuse or difficult to underwrite.

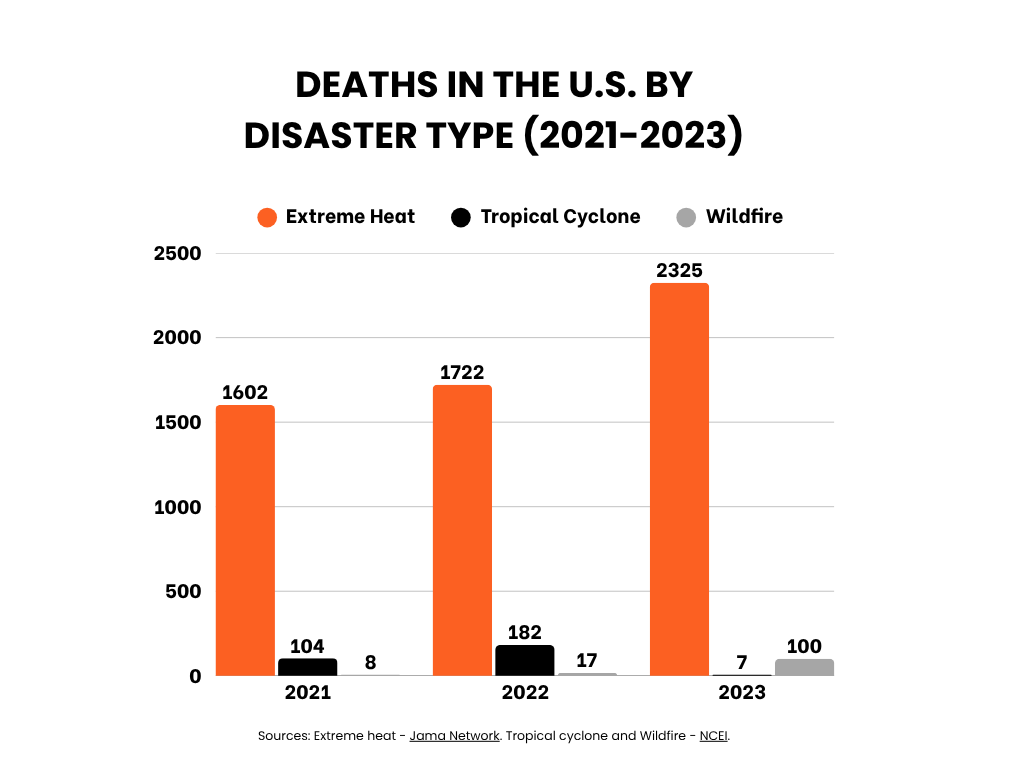

And the deadliest hazard in the United States is not wildfires or floods—it’s extreme heat, which killed over 2,000 people in the U.S. in 2023 alone.

Heat is a slippery risk to insure, as it often leaves no physical wreckage to tally. It erodes health, productivity, and infrastructure performance in slow, uneven ways; that makes it challenging for insurers that are built to cover tangible losses, not cascading human and economic strain.

The industry needs to create “entirely new approaches to making catastrophe risk more accessible,” said Roy Wright, CEO of the Insurance Institute for Business & Home Safety, in a recent conversation with The Epicenter about product innovation. Part of that is focusing on prevention rather than compensation. “Insurers must recognize the resilience actions their consumers and communities take,” says Wright. “This isn’t about discounts. It’s about understanding the risk and monetizing the reward for lower exposures.”

Enter: parametric heat insurance. These policies automatically pay out when a predefined extreme heat threshold is reached. They use an “if/then” trigger related to the event occurring; for example, “if the local temperature exceeds 100°F for 3 days, then pay $500 to the insured within days of the event happening.” In other words, parametric heat insurance is designed to allow outdoor workers to stay at home or take breaks on days when it may be unsafe to be outside—to help workers avoid exposure altogether.

Paying workers to stay home marks a shift in insurance thinking: incentivizing protective action rather than just compensating for harm. And it's a pattern that's increasingly showing up at the fringes of traditional insurance practices, like industrial and commercial mutual insurance company FM's $400 million in “resilience credits” for policyholders to protect themselves against threats like wind, flood, and wildfire. It's risk reduction as a business model, rather than an afterthought.

For now, the parametric heat insurance pilots remain small. The payouts are modest. But in places like Gujarat, India, where over 42,000 self-employed women now have access to parametric heat coverage that pays out when it’s unsafe to work, we're getting a glimpse of what's possible when the industry moves beyond traditional models. The question is how to scale it, tailor it to different regions, and get the right mix of partners involved to make it work.

Read the full article here.

Read more about insurance on The Epicenter here.

Read more about resilient public infrastructure and government solutions on The Epicenter here.

Read more about resilient real estate on The Epicenter here.

The percentage of working hours worldwide that will be lost to high temperatures by 2030. That’s equivalent to 80 million full-time jobs.

Source: Aon and the International Labor Organization.

Have thoughts to share or want to add your voice to the conversation? Reach out!

The Epicenter helps decision makers understand climate risks and discover viable resilience solutions. The Epicenter is an affiliated publication of The Resiliency Company, a 501(c)3 nonprofit dedicated to inspiring and empowering humanity to adapt to the accelerating challenges of the next 100+ years.