The Weekly: Unaffordable Housing—A Hidden Driver of Wildfire Risk?

The housing affordability crisis and the wildfire crisis aren't distinct challenges. They're a self-reinforcing cycle that requires investing in resilience to break.

When the U.S. federal government shut down earlier this week, so did the National Flood Insurance Program (NFIP).

As of Tuesday night, the program, which provides nearly $1.3 trillion in flood insurance to 4.7 million policyholders, expired. During a government shutdown, the NFIP is still able to pay out claims for existing policies, but it cannot renew or issue new policies.

The implications are far-reaching. A lapsed NFIP could halt real estate transactions in locations where mortgages require flood insurance. By law, a lender can only issue a government-backed mortgage for a property in a “special flood hazard zone” if the house is covered by flood insurance—a policy that many private insurers won’t issue.

According to the National Association of Realtors, the NFIP supports over 500,000 homebuying transactions every year. The last time the NFIP expired for an extended period took place in 2010, when it was frozen for 30 days. The National Association of Realtors estimated that the 2010 expiration of the NFIP resulted in the delay or cancellation of 1,400 home sales every day.

This (hopefully) short-term political crisis, which is unfolding with two months to go in the Atlantic hurricane season, only adds to a larger, structural crisis in the insurance industry nationwide. In an article published yesterday in Moving Day, Susan Crawford noted that historically, fires and floods have not had a significant impact on the long-term value of real estate. Insurance was available and affordable, and the government would swoop in to provide support after a disaster struck.

But all of that is beginning to change. Insurers are leaving states like California, while the ones who remain are increasing the price of their premiums (scroll to the bottom of this newsletter to see our new Statistic of the Week section for more detail).

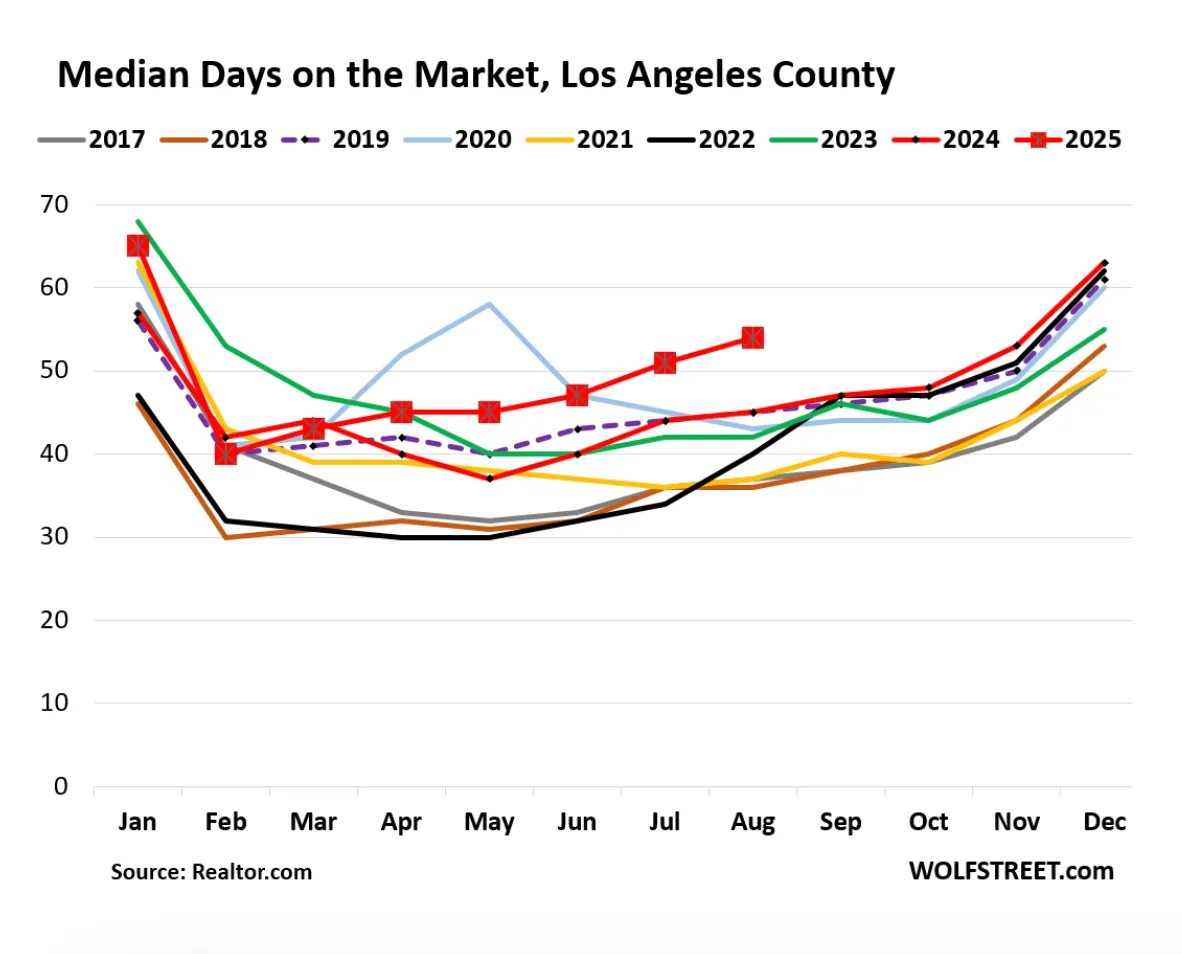

The transition from insurance being available and affordable to expensive and unpredictable is influencing real estate markets. According to Crawford, demand for homes in Los Angeles has “plunged,” in part due to rising insurance costs and increased unpredictability. Today, homes are sitting on the market for more than they have in at least a decade.

These related crises—the NFIP's vulnerability to political gridlock and private insurers' retreat from climate-exposed markets—underscore how insurance enables the entire machinery of U.S. homeownership to function. We're discovering that housing values were always contingent on an assumption of perpetual insurability. When that assumption breaks, so do the markets.

Earlier this week, we published takeaways from an interview with Roy Wright, CEO of the Insurance Institute for Business & Home Safety (IBHS). His perspective is that the only way out is through: insurance companies need to innovate.

In the face of frequent and destructive climate disasters, Wright believes that it will be product innovation, not risk reduction, that will define insurers’ long-term legacy. We’d love to hear what you think.

Read more about insurance on The Epicenter here.

Read more about resilient public infrastructure and government solutions on The Epicenter here.

Read more about resilient real estate on The Epicenter here.

The average cost of a homeowner’s policy nationwide has risen by 30-40% over the last five years. Source: Undark

Have thoughts to share or want to add your voice to the conversation? Reach out!

The Epicenter helps decision makers understand climate risks and discover viable resilience solutions. The Epicenter is an affiliated publication of The Resiliency Company, a 501(c)3 nonprofit dedicated to inspiring and empowering humanity to adapt to the accelerating challenges of the next 100+ years.