The Weekly: Takeaways from 2025’s Climate Disasters

Twenty-three billion-dollar disasters, $115 billion in damage, and not one hurricane: 2025 was a masterclass in how climate risk in the U.S. has changed.

Who pays for resilience? And how does it get financed?

Every conversation at Climate Week in New York seemed to return to these questions.

On Monday, The Resiliency Company co-hosted the Adaptation Forum, a gathering that convened over 200 private investors, insurance company representatives, community leaders, and government officials to explore bright spots and innovations in adaptation and resilience.

Speakers at the Adaptation Forum highlighted that effective adaptation and resilience solutions are all around us. But with disasters occurring more frequently, with more severity, and in more places across the United States, we need to scale these solutions and models, and scaling requires new financial products and innovations.

Consider home fortifications. A 2025 report from Headwater Economics found that rebuilding a 2,000 square-foot home in California to meet the state’s wildfire-resistant standards adds $30,000 to construction costs—up to a 10% premium on typical construction costs. When most insurance payouts fall below the baseline replacement costs of construction, many homeowners are left to cover these improvements out of pocket.

The stakes are high. Homeowners in areas prone to repeat disasters could lose their insurance entirely—a phenomenon currently occurring in California, as insurers decide to cancel policies and leave the state. Since 2019, one in five homes in the most extreme fire-risk areas of California have lost insurance coverage.

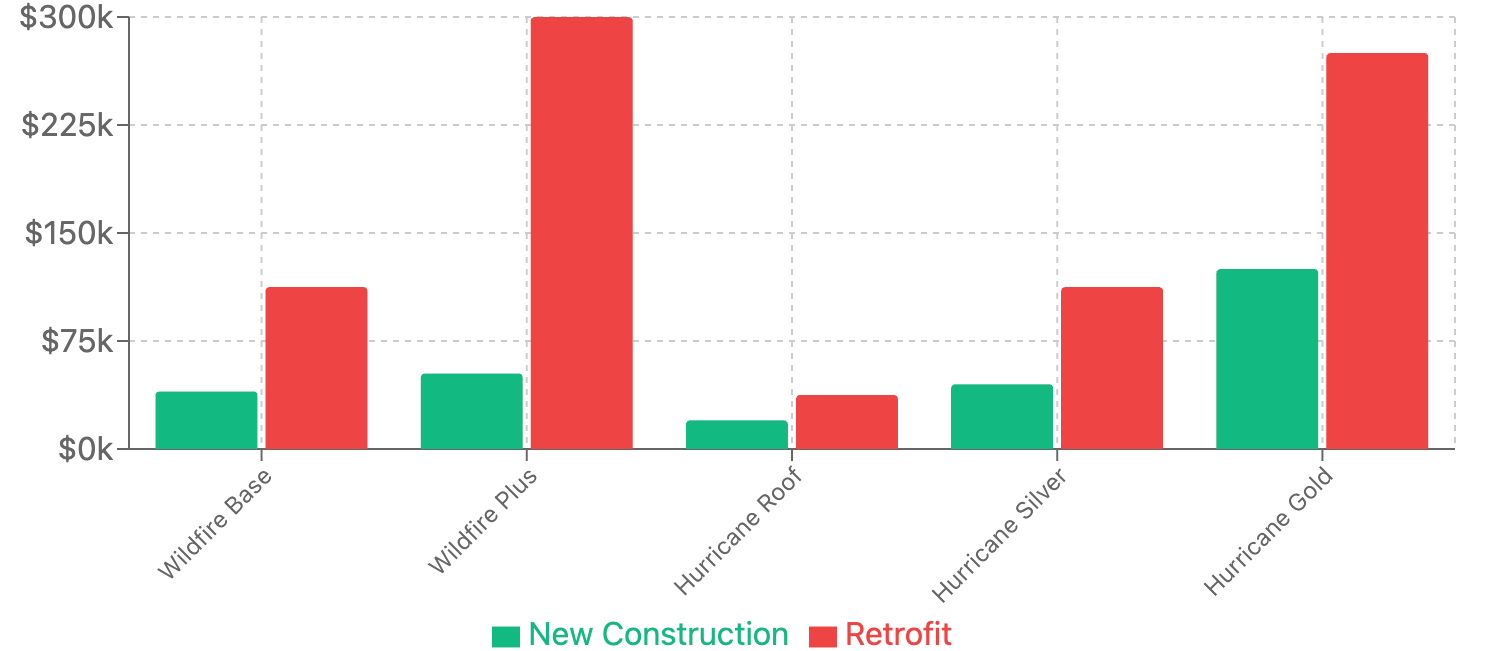

But after a disaster, such as the Los Angeles fires in January, there’s an opportunity to rebuild with resilience in ways that are less expensive than home retrofits. This is because it can be less costly to rebuild from the ground up to new standards than to retrofit existing structures, one by one. To rebuild an entire home to meet the IBHS standard of a Wildfire Prepared Home, it can cost between $35,000 and $60,000 more than it would cost to rebuild to current building codes. To retrofit an existing structure, costs often start at $150,000.

This is the "Resiliency Delta" – the difference in what financing options currently cover and what it takes to build to the highest safety and damage prevention standards.

While government, insurers, and mortgage holders all benefit from a resilient housing stock, homeowners ultimately bear the long-term risk of losing their homes or having them become uninsurable. We need financial products that address this specific problem.

The good news is that there’s plenty of precedent for designing financial products for homeowners. The Federal Housing Administration (FHA) offers a blueprint for what’s possible. Founded in 1934, the organization was created to make homeownership more affordable at a time when only one in ten Americans owned a home. The FHA reduced down payment requirements, extended loan terms up to 30 years (most loans in the 1920s and 1930s spanned 3-5 years), and introduced the concept of FHA loans for first-time homebuyers.

We need that same innovative spirit today—but focused on financial products that make climate-resilient retrofits and rebuilds affordable for every homeowner.

Have thoughts to share or want to add your voice to the conversation? Reach out!

The Epicenter helps decision makers understand climate risks and discover viable resilience solutions. The Epicenter is an affiliated publication of The Resiliency Company, a 501(c)3 nonprofit dedicated to inspiring and empowering humanity to adapt to the accelerating challenges of the next 100+ years.