The Weekly: Takeaways from 2025’s Climate Disasters

Twenty-three billion-dollar disasters, $115 billion in damage, and not one hurricane: 2025 was a masterclass in how climate risk in the U.S. has changed.

Twenty-three billion-dollar weather and climate disasters struck the United States in 2025, revealing important takeaways for decision-makers in the real estate, public infrastructure, and insurance sectors.

By Maddie Vann, Executive Editor for The Epicenter and Head of Strategy for The Resiliency Company

Twenty-three billion-dollar weather and climate disasters struck the United States in 2025, causing an estimated $115 billion in damage and 276 fatalities, according to Climate Central.

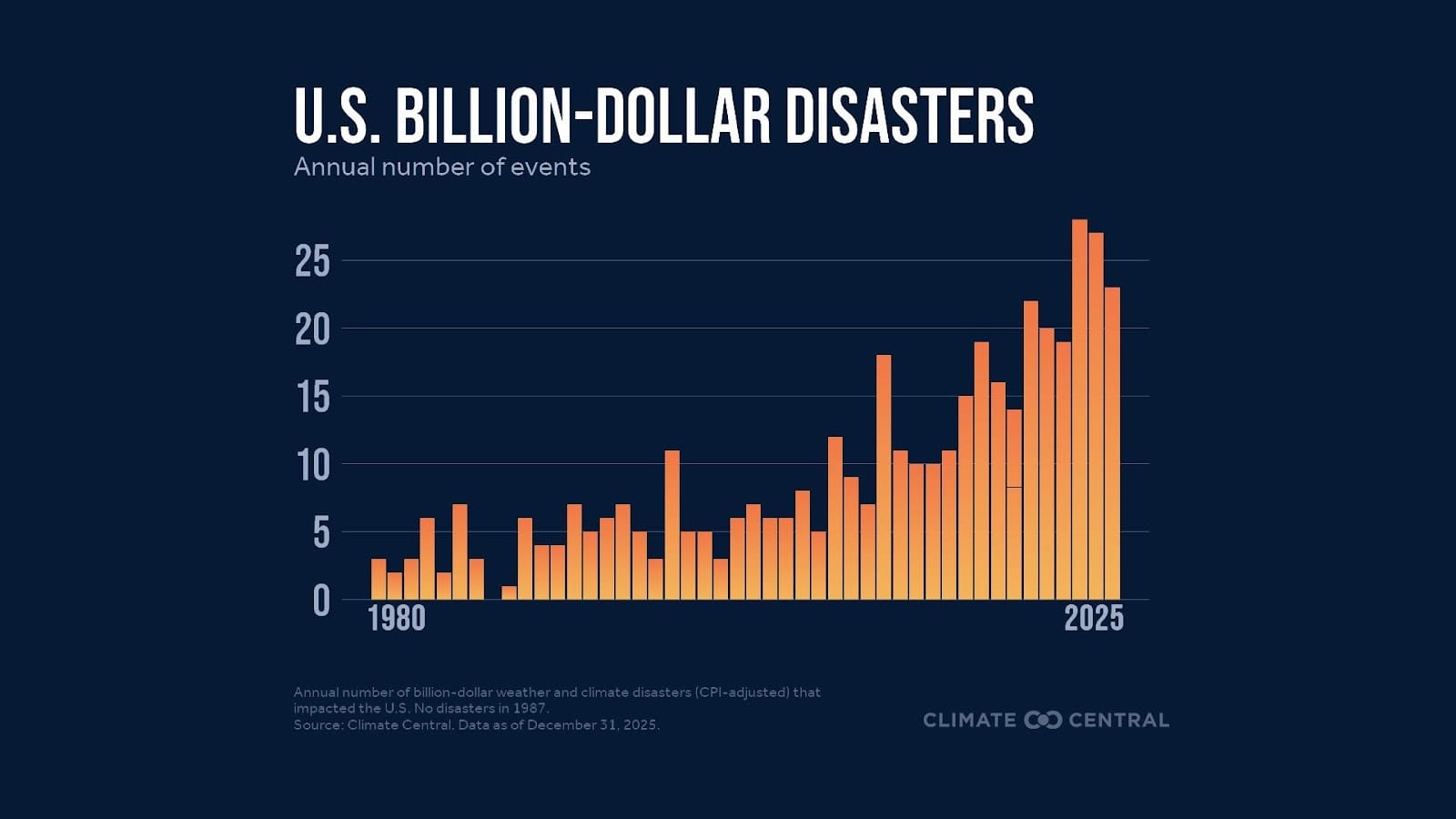

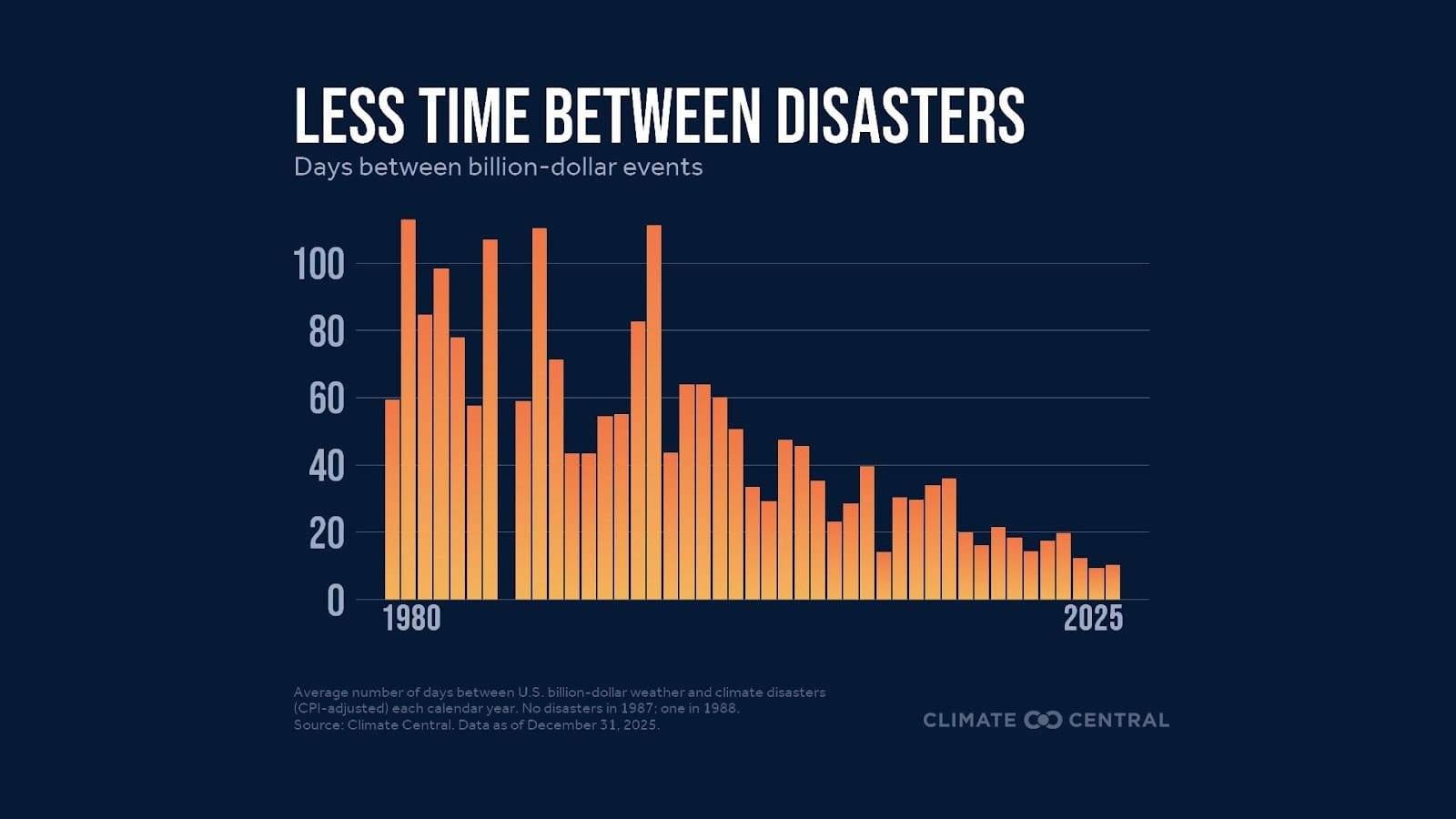

The numbers tell a story of escalating risk: both the frequency and the costs of such disasters have climbed steadily since 1980, when NOAA began tracking this data.

In the 1980s and 1990s, single-digit disaster counts were the annual norm, and an average of 100+ days often passed between billion-dollar events. In 2025, that average was down to 10 days between disaster events.

And these escalating disasters aren’t just tragedies; they’re reshaping the American economy.

Since 2000, roughly 36% of U.S. GDP has come from spending related to recovery from or preparing for disasters, according to Bloomberg Intelligence research. What was once an exceptional cost has become a structural feature of economic activity, with implications for how capital gets allocated, how communities plan for the future, and who ultimately bears the financial burden.

No hurricanes made landfall in the U.S. in 2025, a detail that makes the year's significant damage costs particularly striking. By comparison, 2024 saw $188 billion in total damage, of which $128 billion was from hurricane damage alone.

Instead, 2025 was defined by several historic events—like the Los Angeles wildfires and catastrophic Texas floods—alongside a relentless series of severe storms that caused widespread damage but received less national attention.

Meanwhile, federal budget cuts and shifts in responsibility to state and local governments have left many insurers, investors, and communities uncertain about how they will respond to future disasters. The near-loss of NOAA's billion-dollar disaster database, covered in a recent edition of The Epicenter’s The Weekly, underscores how fragile the climate data infrastructure in the U.S. has become.

The U.S. didn’t see a single hurricane last year, but we didn’t get off easy. In this article, we examine the financial impacts of the L.A. wildfires, severe storms as a collective, and the Texas floods. We explore these disasters across three dimensions—real estate impacts, public infrastructure impacts, and insurance impacts—to help decision-makers better understand the consequences of large-scale climate disasters.

The scope of the damage from the Los Angeles wildfires was immense, with one independent analysis placing the total economic cost between $250-275 billion. The real estate, public infrastructure, and insurance sectors have had to rapidly adapt in the wake of this disaster.

The L.A. wildfires revealed how a single catastrophic event can simultaneously stress multiple pillars of community resilience—overwhelming insurance markets, straining public resources, and fundamentally reshaping the economics of real estate development in high-risk areas.

Real estate impacts: According to a UCLA analysis, property and capital losses from the L.A. fires ranged from $76-131 billion, with more than 16,000 structures destroyed (the variation in estimates reflects different methodologies for calculating indirect economic impacts). One year later, Realtor.com estimates that last year’s fires erased $8.3 billion in home value in the Pacific Palisades and Altadena, and that property values in both cities are still 15-20% under pre-fire norms. Initial rebuilding efforts have proceeded slowly, but they have also prompted local governments to accelerate permit issuance and have sparked a wave of innovations to streamline resilient construction, including the Foothill Catalog’s pre-approved home designs, Case Study: Adapt’s resilient homes project, and Resilient L.A’s grants guidebook.

Public infrastructure impacts: California received $5.7 billion in FEMA aid for the L.A. wildfires, yet the federal government has not issued the additional $33.9 billion requested. As the state shoulders responsibility for recovery, Governor Newsom has issued a suite of executive orders designed to speed up repair and rebuilding, including faster removal of debris and changing permitting laws. The state has also begun drafting tougher defensible space rules for homes in high-risk "Zone Zero" areas.

Insurance impacts: According to a Swiss Re Institute report, the U.S. accounted for a staggering 83% of global insured losses in 2025. Most of that is due to the L.A. wildfires, which caused insured losses of $40 billion. Munich Re agrees, noting that these were “by far the largest insured loss on record from a wildfire event.”

In response, the California Department of Insurance is proposing “groundbreaking regulation” to promote strategic adaptation rather than retreat. Insurers would be required to “develop comprehensive plans outlining how they manage their climate, technology and emerging financial risks.”

Watch this space—the impacts here are likely to spread beyond California as other states face similar insurance market pressures.

Severe storms are often overshadowed by hurricanes and wildfires, but as we explore in The Epicenter’s Severe Storms Hazard Briefing, they add up. In 2025, twenty-one separate severe storms each caused $1 billion or more in damage, totaling $51 billion in total damage from severe storms in the U.S. in 2025.

Unlike singular headline-grabbing disasters, the cumulative impact of severe storms demonstrates how repeated 'smaller' events can steadily erode affordability, strain local budgets, and shift insurance risk inland–challenging the assumption that climate disasters are primarily a coastal concern.

Real estate impacts: This trend—frequent, major storm damage—will only intensify as more people and property sit in harm's way. In 2025, the Central Tornado Outbreak stands out as the most destructive single event, damaging 4,500 structures and resulting in total damage and economic losses estimated at $9-11 billion. Five separate hailstorms caused more than $1 billion in damage each, pointing to a growing reality: escalating hail risk is an expensive and complex problem. Bryan Wood of Munich Re Specialty says “hail is the costliest sub-peril of severe convective storms, compared to tornado and wind,” and is causing the “cost of roofing materials to jump up in the U.S. by around 18% since 2020.”

A November 2025 research report from S&P Global cited additional implications for the real estate industry from increasingly frequent hailstorms:

“...factors such as roofing age, condition and materials in areas prone to frequent and severe hailstorms will play a critical role in determining a home's value. These shifts in risk assessment could have far-reaching implications throughout the real estate market, affecting not only homeowners but also originators and holders of mortgage loans.”

Public infrastructure impacts: Severe storms were another source of uncertainty when it came to federal support. Under President Trump, FEMA denied federal assistance for tornadoes in Arkansas, flooding in West Virginia, and a windstorm in Washington state. While funding was eventually approved for Arkansas after initial denial, the pattern demonstrates that the federal government can no longer serve as a reliable backstop for disaster aid under the current administration. This shift is especially significant for the many states at high risk of severe storms that do not yet have a resilience office or officer or a finalized state-led adaptation plan.

Insurance impacts: U.S. severe convective storm insurance losses reached $42 billion in the first nine months of 2025. The financial pressure is spreading: home insurance premiums are on the rise in the middle of the country, primarily driven by more frequent hail damage. The Insurance Institute for Business and Home Safety’s (IBHS) FORTIFIED building standard (also covered in The Epicenter’s Severe Storms Hazard Briefing) offers a viable path forward and was validated by post-storm research published in May 2025. The University of Alabama’s Center for Risk and Insurance Research (CRIR) found that homes built to the FORTIFIED standard performed much better than non-FORTIFIED homes during 2020’s Hurricane Sally. Six states now offer incentives specifically to build or upgrade to a FORTIFIED home, including insurance discounts, and a growing number of states are requiring insurers to offer discounts for FORTIFIED buildings.

One of the most severe inland flood events in U.S. history struck Texas in 2025, with estimated damages between $18-22 billion.

The Texas floods exposed a mismatch between mapped risk and actual vulnerability, forcing a reckoning about whether communities should retreat, fortify, or reimagine flood protection—with most financial burden falling on unprepared homeowners rather than insurance systems.

Real estate impacts: Cotality estimates over $1 billion in damage from the Texas floods to residential buildings alone. The floods exposed a broader vulnerability in Texas real estate: FEMA flood maps underestimated risk, leaving many property owners vulnerable and uninsured. As a result, the rebuilding process has been complicated by debates over whether to relocate or fortify—a decision that will shape development patterns for decades. The discussion around federal flood mapping resurfaced when Zillow removed its year-old feature in November 2025 that showed a listing’s climate risk, including flood risk. With no single verified, well-documented dataset, “we have ended up with a messy tangle of assertions that can obscure genuine climate risks for many prospective homebuyers,” says Susan Crawford in a December Moving Day post.

Public infrastructure impacts: Texas has responded to the floods by making new funding and investments at the state level to accelerate local recovery and resilience. One big trend to watch: these efforts increasingly incorporate natural infrastructure, like wetlands restoration and the introduction of green spaces, to reduce the burden on existing drainage systems. This is an important part of the climate adaptation conversation: nature-based solutions can work alongside traditional engineering to reduce flood risk and protect communities.

Insurance impacts: The collective insurance impact is one major way in which the Texas floods diverge from the other major disasters of 2025. Flood insurance penetration in the region is low, meaning that most losses fell directly on homeowners rather than insurers. According to the Neptune Research Group, only 7% of homes in the state have flood insurance; in FEMA-designed high-risk zones, that only rises to 28%. The National Flood Insurance Program (NFIP) requires communities to adopt minimum floodplain management standards, but such low adoption limits the ability of the NFIP to influence safer development.

The scale of 2025's disasters shouldn't obscure what's being built in their aftermath. Look between the big headlines about damage totals and another pattern appears: resilience is spreading. As Matt Posner and Xavier de Souza Briggs noted in a recent Brookings article, "the U.S. has made real progress raising public awareness of the need for climate adaptation and developing planning and engineering strategies to address increasing risk and extreme weather."

Across the U.S., forward-looking states are implementing new building codes, investing in resilient infrastructure, and creating innovative financing mechanisms. As resilient building strategies gain momentum, some of the first generation of fire-resilient houses survived the L.A. wildfires.

At the same time, investors are starting to reward climate adaptation, and companies connected to disaster preparedness and recovery have significantly outperformed the S&P 500 over the last 10 years. As federal support declines, private companies are emerging to fill gaps—a shift that presents opportunity but also raises questions about fair access, oversight, and long-term community resilience. This changing landscape reflects a growing flow of attention and investment toward resilience, reshaping the roles of public institutions, private actors, and communities in recovery and rebuilding.

Each disaster teaches us how to soften the impact of the next one. Across the country, communities, decision-makers, and investors are already demonstrating that the blueprints for a more resilient future already exist.

Have thoughts to share on this piece, or want to add your voice to the conversation? Reach out!